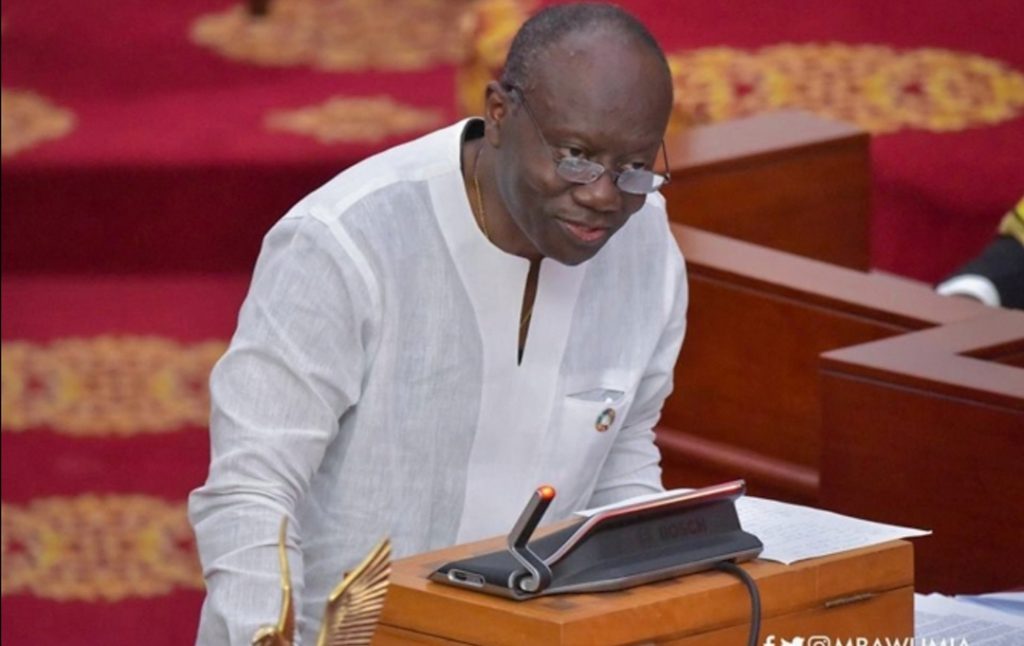

There will be no more wasteful tax exemptions – Ken Ofori Atta

The Finance Minister, Ken Ofori Atta has stated that it will simplify the country’s tax system in order to prevent huge corporations from exploiting tax exemptions.

The government claims it is putting in place measures to deal with unnecessary tax exemptions, as Ghana loses roughly 5% of its GDP each year due to excesses in taxes of enterprises operating in the free zones enclave.

On Wednesday, November 17, 2021, Minister of Finance Ken Ofori-Atta disclosed this during of the 2022 budget statement and economic policy at parliament .

He stated that the government will reduce excessive tax exemptions through the Exemptions Bill, which will be brought to the House in 2022, in order to ensure that the country reaps major benefits from enterprises that benefit from tax exemptions.

“We wish to reiterate that we are in challenging times, which require radical measures; so, let us embrace these new policies to enable the government to address the fundamental issues affecting the economy to ensure that our nation continues to maintain its position”.

The Minister also stated that the Value Added Tax (VAT) rebate on African prints for textile makers in the country will be extended for another two years. The extension, he claims, will allow them to resurrect their business and deliver affordable textiles to the market.

Mr Ofori-Atta further stated that the 3% VAT (flat rate) on wholesalers and retailers’ supply of goods, which was implemented in 2017, will now be limited to only retailers, noting that all other supplies of goods and services will be subject to the regular rate.

The flat rate’s goal, according to the minister, is to provide a simplified system for small businesses, and the rate will be applied to stores with annual turnovers of less than GHS500,000 to ensure that this goal is met.

The normal fee will be applied to all other merchants and wholesalers.