Kwame Oppong, Director of Fintech and Innovation at the Bank of Ghana, has urged mobile money agents to collaborate in protecting the industry from fraudsters and criminals.

Speaking at the 7th-anniversary celebration of the Mobile Money Advocacy Group Ghana (MoMAG) in Accra on Saturday, September 7, he highlighted the importance of trust and confidence in mobile money operations. Oppong stressed that safeguarding the industry is crucial for its continued role in promoting financial inclusion.

“The work you have put in over the last decade and a half needs to be protected; you have weathered many storms, but one of which has become important today is the issue of trust and confidence.”

“Fraudsters, criminals, and those who seek to destroy the wonderful business that you have worked together with the mobile money industry to build, you should not let them take it away; you should not let their intentions take root,” he said.

To address this, he announced plans to integrate MoMAG into a governance framework designed to curb the activities of fraudsters and criminals.

“We are going to work on a governance framework to protect this industry from fraud and criminality, and I will be extending a hand officially to your association to have a seat at the table.”

He praised MoMAG members for their substantial role in advancing financial inclusion in Ghana, highlighting the industry’s growth and its positive impact on people’s lives.

“You have been representatives of people’s hope when they receive money in deep, faraway places. I have seen your locations from Bimbilla to Axim to everywhere. Your work is not easy; you have committed a lot of your resources, and today we are here to honour you.”

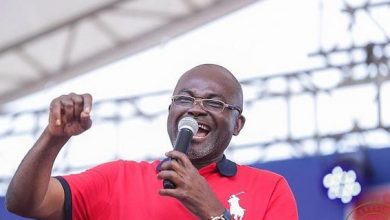

Ing. Dr. Kenneth Ashigbey, the Chief Executive Officer of the Ghana Chamber of Telecommunications, praised the group for making banking services more accessible to the general public. He also encouraged mobile money agents to expand their offerings to include additional financial services, such as mortgages.

Dr. Kenneth Ashigbey, Chief Executive Officer of the Ghana Chamber of Telecommunications, called on MoMAG and other stakeholders to enhance the security and safety of mobile money agents.

“We need to work collaboratively to address this issue. It requires collective effort with Mobile Money Ltd., the Bank of Ghana, the NCA, and other regulators,” he stated.

Regarding the future of mobile money in Ghana, he emphasized, “The potential of mobile money extends beyond mere transactions. It involves developing an integrated digital economy where financial services are readily accessible to every Ghanaian, irrespective of their location or socioeconomic status.”

Dr. Ashigbey also urged ongoing collaboration among telecom operators, fintech companies, banks, government agencies, and organizations like MoMAG to build a strong and inclusive financial ecosystem.

He advised mobile money agents to avoid practices such as overcharging, inadequate record-keeping, and unprofessional customer service, which can erode trust and confidence in the sector.