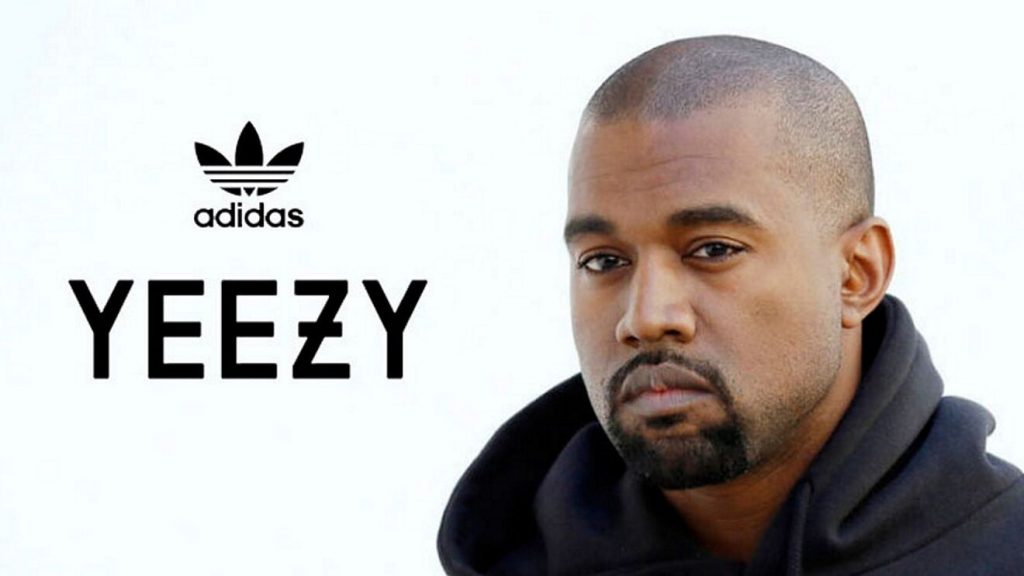

Adidas has announced its intention to sell off the remaining inventory of Yeezy sneakers from its terminated partnership with Kanye West at or above cost price.

This move follows the brand’s decision to sever ties with the rapper, also known as Ye, in 2022 after he made a series of antisemitic remarks on social media. Despite the fallout, demand for Yeezy sneakers remains robust, particularly in the resale market.

The decision comes amidst financial challenges for Adidas, including currency fluctuations that cost the company €1 billion.

The discontinuation of the Yeezy business and price reductions to clear excess inventory contributed to these challenges.

Adidas CEO Bjørn Gulden, who was appointed in 2023 to steer the company’s turnaround post-Yeezy, stated, “The improvement is due to the better operating business of around €100 million and the decision to not write off €268 million of Yeezy inventory.”

The breakup with Yeezy left Adidas with unsold sneakers valued at approximately €1.2 billion.

Despite some Yeezy inventory being sold in the previous year, Adidas experienced a net sales decline of around €450 million from the partnership compared to 2022.

To mitigate losses, Adidas plans to sell the remaining Yeezy stock at a minimum covering production costs.

However, the company anticipates a potential write-off of its remaining Yeezy items, which could amount to €300 million.

Furthermore, Adidas cited the devaluation of the Argentine Peso at the end of 2023 as another factor impacting its profits.

This devaluation was part of Argentina’s economic restructuring efforts, which also affected rival sportswear company Puma, given the region’s significance as its largest and fastest-growing market.

As both Adidas and Puma navigate the challenges posed by currency fluctuations and market dynamics, they underscore the broader impact of geopolitical and economic factors on global corporations.

Source-BBC