After the International Monetary Fund (IMF) approved and provided funds for a US$3 billion Extended Credit Facility (ECF) arrangement, the country’s gross reserves are anticipated to potentially increase.

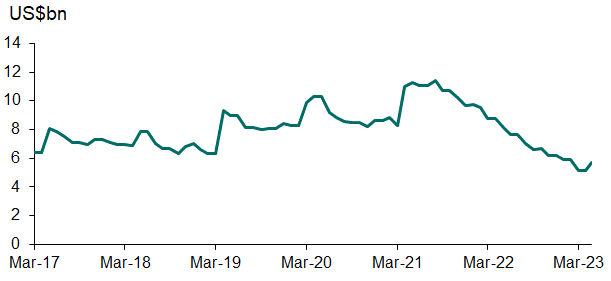

The gross reserves for April increased slightly from US$5.1 billion in March to US$5.2 billion at the end of the year’s fourth month, according to the Bank of Ghana’s review of economic and financial data.

This achievement was recognized by the central bank, which noted that as of May 19, reserves had increased to US$5.7 billion, or 2.6 months’ worth of import coverage. Nevertheless, despite this improvement, the figure remains below the IMF’s suggested benchmark of three months’ insurance.

Because of central bank involvement in the foreign exchange (FX) market, reserves have decreased by around 17% since the year’s beginning. These steps were taken to moderate the Cedi’s devaluation in the face of a difficult macroeconomic and fiscal environment that was made worse by the US dollar’s increasing scarcity.

However, indicators on the trade balance support a favourable prognosis. According to the most recent data, the country’s trade balance is still in good shape, having increased by a significant 2.2 per cent of GDP from the same time last year, when it was only 1.6 per cent of GDP. This development can be ascribed to a drop in imports, which have fallen by 14% so far this year compared to the same period last year.

A surplus of US$661 million was also recorded in the current account in the first quarter of 2023, as opposed to a deficit of US$554 million in the same period of 2022. The larger trade surplus, cheaper services and income payments as a result of the suspension of the payment of external debt, and higher remittance flows are all credited with this development.