The cedi is still relatively strong despite the economy’s poor fundamentals.

This is according to market analysts GCB Capital and Constant Capital.

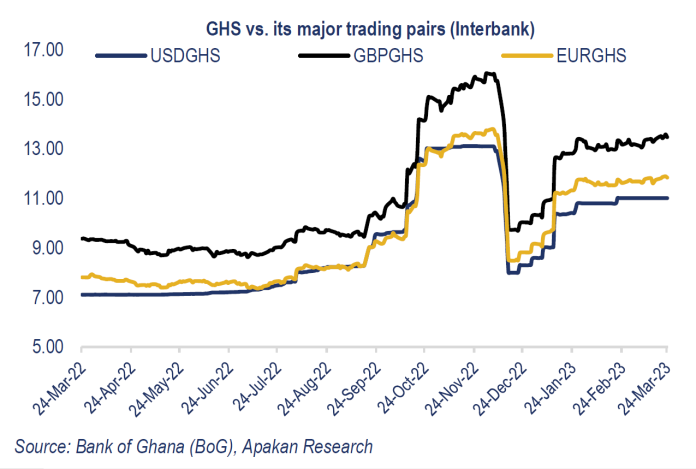

Even though the local currency has fallen by 4.4 per cent against the US dollar as of March 28, the performance has outperformed market expectations due to expected seasonality effects in Q1 2023 amid a weaker position in foreign exchange reserves and a highly pessimistic end to 2022, while the interbank reference rate has fallen by 22 per cent.

The Bank of Ghana’s efforts to reduce market spreads and speculative activity is seen to be the cause of this. Export receipts have supported a year-on-year surplus for the merchandise trade account despite worries about a weakened position in the foreign exchange reserves.

In its report analyzing the recent Monetary Policy Committee (MPC) decision to raise the policy rate by 150 basis points, GCB Capital suggested that limited trading activity on the Ghana Fixed Income Market [GFIM] has reduced FX demand pressure from portfolio reversals, further supporting the cedi’s strength.

Meanwhile, the progress in negotiations with China has taken the nation closer to receiving IMF Executive Board approval. Formal commencement of the IMF programme is anticipated to release a balance of payment backstop for the cedi’s resilience in the second half of 2023.

The market is generally of the opinion that the country’s success in talks with China has advanced its chances of receiving IMF Executive Board approval, which should free up a balance of payment backstop and strengthen the cedi’s resilience into the second half of 2023. Analysts pointed out that the performance of the local unit will depend on how well Ghana’s foreign debt is restructured and how well it can obtain guarantees from its bilateral creditors and capital market bondholders.

According to Apakan Securities, who expressed a similar opinion, market sentiment has improved as a result of developments on the treatment of local debt and increased government involvement with its external creditors.