Executives of the Ghana Hoteliers Association (GHA) are urging the government, through the Ministry of Finance, to merge the National Health Insurance Levy (NHIL), Value Added Tax (VAT), and the Ghana Education Trust Fund (GETFund) into a single tax for the hospitality sector.

The group explained that the current tax structure, combined with high inflation, currency volatility, and rising utility costs, is putting significant pressure on hotel businesses.

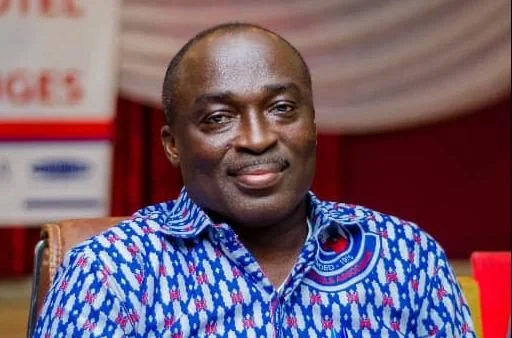

In an interview with Accra-based Citi FM, Dr. Edward Ackah-Nyamike, President of the GHA, stressed the need for immediate reforms.

“We have made our points very clear over the years, so we want to see something on taxes and levies hopefully reduced and some taken out, as promised by the government.

We also want to see measures in place to deal with the economic environment that affects our business, like inflation, foreign exchange, and utility tariffs.”

“If any of these things are dealt with in a manner that will show some positive signs that will allow our business to flourish, why not? We will be very happy. We have been pushing for a consolidation of the taxes so that, for the hotel industry, we will have one tax that consolidates VAT, GETFund, NHIL, and all that,” Dr. Ackah-Nyamike stated.