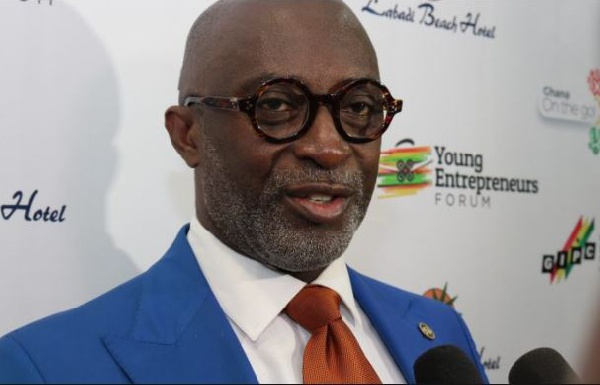

Yofi Grant, Chief Executive Officer of the Ghana Investment Promotion Authority (GIPC), has voiced concerns about the persistent harassment faced by foreign-owned businesses from tax officers of the Ghana Revenue Authority (GRA).

He revealed that the GIPC office receives daily visits from at least three to five foreign businesses, which come to report issues related to ongoing harassment over fluctuating tax charges and policies.

The GIPC is a state agency tasked with promoting investment opportunities for both local and international investors.

Speaking as a panellist at the Canada-Ghana Chamber of Commerce (CANCHAM), Mr. Grant warned that this harassment, coupled with other investor concerns such as unfavorable tax policies, exchange rate volatility, and inflation, poses a significant threat to the business environment in Ghana.

He cautioned that these challenges could potentially diminish the country’s attractiveness as an investment destination, particularly troubling given the notable decline in foreign direct investments to Africa following the COVID-19 pandemic.

The CEO of the Ghana Investment Promotion Centre (GIPC) has called for a collaborative approach to addressing tax-related issues. This would ensure fair treatment for investors and foster a stable business environment.

Mr. Grant’s appeal comes at a crucial time. Since 2017, domestic economic conditions have been heavily influenced by new tax policies. Investors and businesses are facing challenges such as high interest rates on loans, local currency volatility, high inflation, and additional taxes that impede business growth and sustainability.

High taxes can reduce consumer spending and business investment, leading to lower overall economic activity. This decline in activity can slow economic growth and, consequently, lower the total tax revenue collected by the government.