Mahama promises to scrap e-levy, COVID levy and other levies in first 100 days

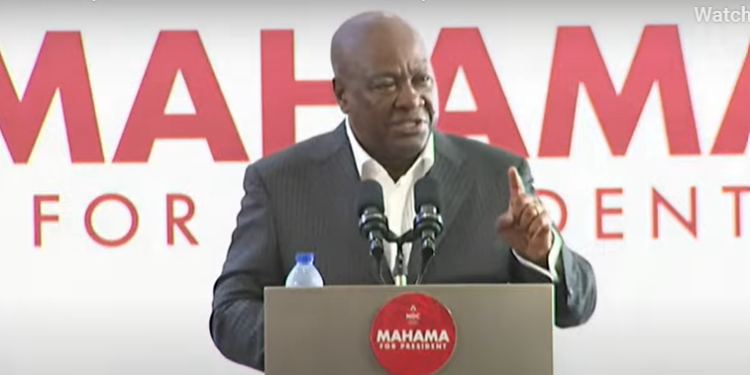

John Dramani Mahama, the National Democratic Congress (NDC) Presidential Candidate, has pledged to eliminate several controversial taxes within the first 100 days of his potential presidency in the 2024 general elections.

Speaking at the NDC’s manifesto launch in Winneba on Saturday, August 24, Mahama committed to scrapping the e-levy, COVID levy, the 10% tax on bet winnings, and the emissions levy.

“We will scrap the following draconian taxes within our first 100 days in office to alleviate hardships and ease the high cost of doing business: E-levy, COVID levy, 10% levy on bet winnings, Emissions levy.”

Mahama stated that these tax removals are aimed at easing financial burdens and reducing the high cost of business operations in Ghana. He also promised to abolish import duties on vehicles and equipment used for industrial and agricultural purposes.

Additionally, Mahama outlined plans to apply the Price Stabilization and Recovery Levy on fuel to stabilize fuel prices and rationalize port fees to lessen the impact on importers.

He further pledged a comprehensive overhaul of Ghana’s VAT system, including reversing the VAT flat rate regime, decoupling GETFund and NHIL from VAT, increasing the VAT registration threshold to benefit small businesses, and removing VAT on domestic electricity consumption.

“To further ease hardships, we will: Apply the Price Stabilization and Recovery Levy on fuel to

cushion consumers. Rationalise fees at our ports to reduce the burden on importers and Ghanaians.”

“Undertake a comprehensive reform of Ghana’s VAT regime to provide relief for households and businesses. This will include reversing the decoupling of GETFund and NHIL from VAT, reversing the VAT flat rate regime, upwardly adjusting the VAT registration threshold to exempt micro and small businesses and repealing the law imposing VAT on domestic electricity consumption.”