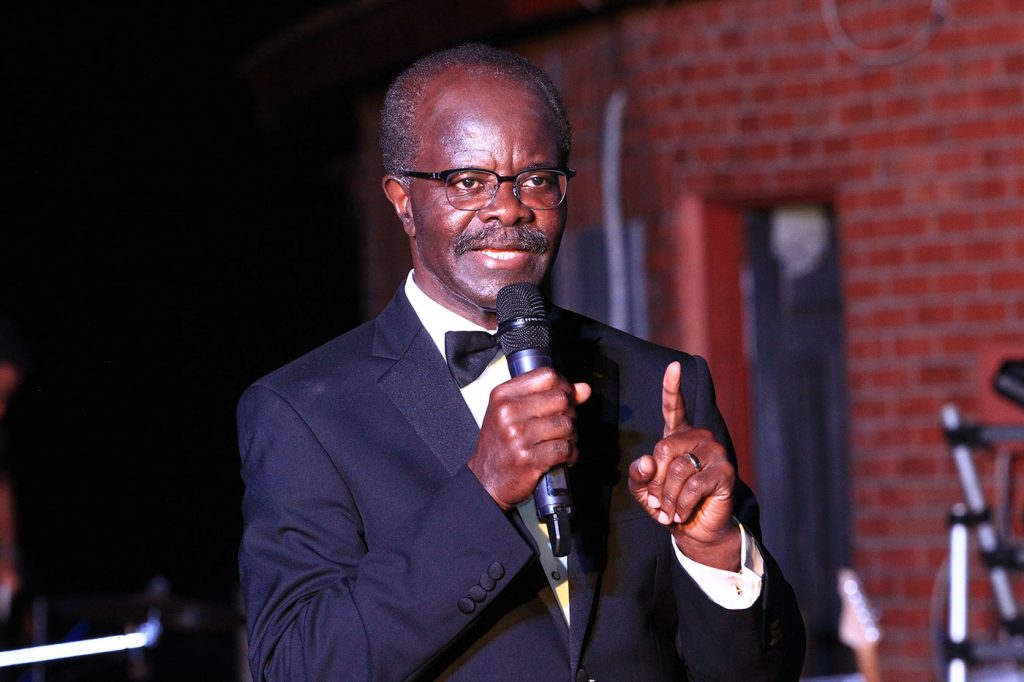

Dr. Kwesi Nduom urges Bank of Ghana to reinstate GN Bank’s license and assets

Dr. Kwesi Nduom, owner of the defunct GN Bank, has made an earnest appeal to Dr. Ernest Addison, the Governor of the Bank of Ghana (BoG), requesting the reinstatement of the bank’s license and the restoration of its assets, which were revoked due to the bank’s insolvency.

Dr. Nduom’s plea comes amidst claims of new evidence that he believes warrants a reevaluation of the bank’s financial status.

In his appeal, Dr. Nduom emphasized the viability of GN Bank’s assets and urged the BoG Governor to ensure their preservation, expressing readiness to resume operations if the license is reinstated. He highlighted that GN Bank’s assets remain in good condition and could be revitalized effectively.

The Bank of Ghana revoked the licences of several financial institutions, including GN Bank, in 2018 as part of measures to consolidate the banking sector. On June 14, the BoG defended its decision to revoke GN Bank’s license in 2019, citing significant regulatory breaches.

The Central Bank stated that GN Bank failed to meet critical financial regulations and banking standards, including capital adequacy, liquidity, governance, and risk management requirements.

Dr. Nduom, in a Facebook post on June 23, contested the BoG’s assertion regarding GN Bank’s insufficient capital adequacy.

He urged Dr. Addison to reconsider the evidence presented in the 2019 GN Savings and Loans transition report, which he claims shows that the bank had adequate funds contrary to the BoG’s findings.

Dr. Nduom appealed for recognition of the new evidence and requested the return of GN Bank’s licence and assets.

He emphasized the importance of maintaining the assets in good condition and expressed the bank’s preparedness to restart operations, even as a savings and loans company.

Dr. Nduom envisioned the reemployment of thousands of people upon the restoration of the bank’s licence.

He highlighted the importance of financial inclusion and the bank’s potential to serve communities through its extensive branch network.

He pointed out that for a savings and loans company, a capital of GHC15 million is required. Despite the finance ministry’s erroneous report of GHC30.3 million, he asserted that GN Bank had sufficient capital and assets to meet regulatory requirements.

He criticized the BoG’s appointed receiver for neglecting the bank’s properties, leading to their deterioration.

Dr. Nduom concluded by reiterating the bank’s readiness to resume operations and contribute to Ghana’s financial sector once the license and assets are restored.