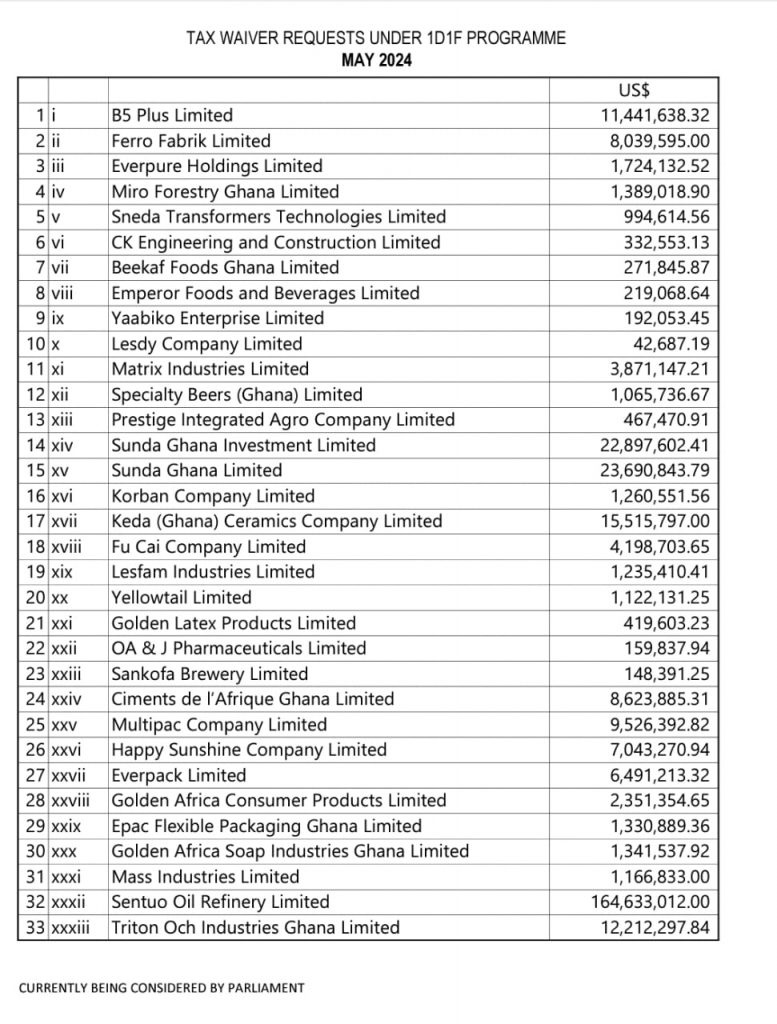

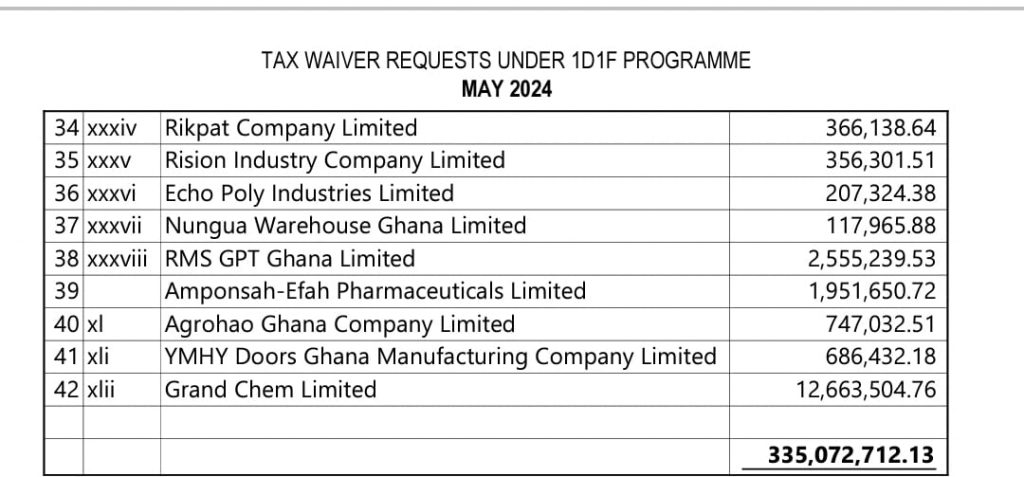

In 2021, the Ministry of Finance initiated processes to secure approximately $335,072,712.13 in tax exemptions for 42 companies participating in the government’s One District One Factory (1D1F) initiative.

This significant financial support is part of the Exemptions Act, 2022 (Act 1083), presented to Parliament by the former Minister for Finance, Ken Ofori-Atta, in 2022.

Among the beneficiaries, Sentuo Oil Refinery Limited stands out with the highest exemption amounting to $164,633,012.00.

The 1D1F initiative, championed by President Nana Addo Dankwa Akufo-Addo, aims to transform Ghana’s economy from reliance on raw material imports and exports to a focus on manufacturing, value addition, and the export of processed goods.

President Akufo-Addo envisioned the initiative as a private sector-led effort, with the government providing a conducive environment for businesses to secure funding from financial institutions and access support services from government agencies to establish factories across the country.