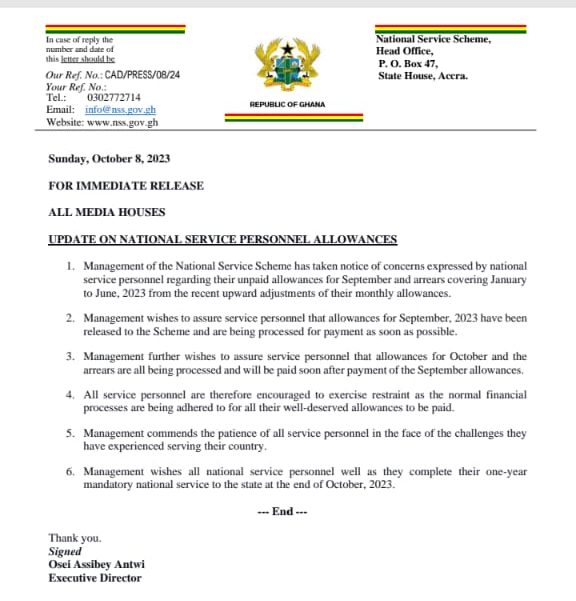

NSS assures its personnel that their September 2023 allowances will be paid soon

The National Service Scheme (NSS) has provided assurance to its personnel that the allowances for September 2023 have been received by the Scheme and are currently in the process of being prepared for payment as soon as possible.

Additionally, the NSS has stated that allowances for October and the arrears resulting from the recent adjustments will also be processed and disbursed shortly after the September allowances are paid.

In response to concerns raised by personnel regarding the non-payment of their September allowances and the arrears for the period from January to June 2023 following the recent increase in their monthly allowances, the NSS has encouraged its personnel to remain patient as standard financial procedures are followed to ensure the timely disbursement of their well-deserved allowances.

The NSS also commended the patience of all service personnel in light of the challenges they have encountered while serving their country, and it extended its best wishes to them as they conclude their mandatory one-year national service to the state at the end of October 2023.