BusinessEditorial PickNews

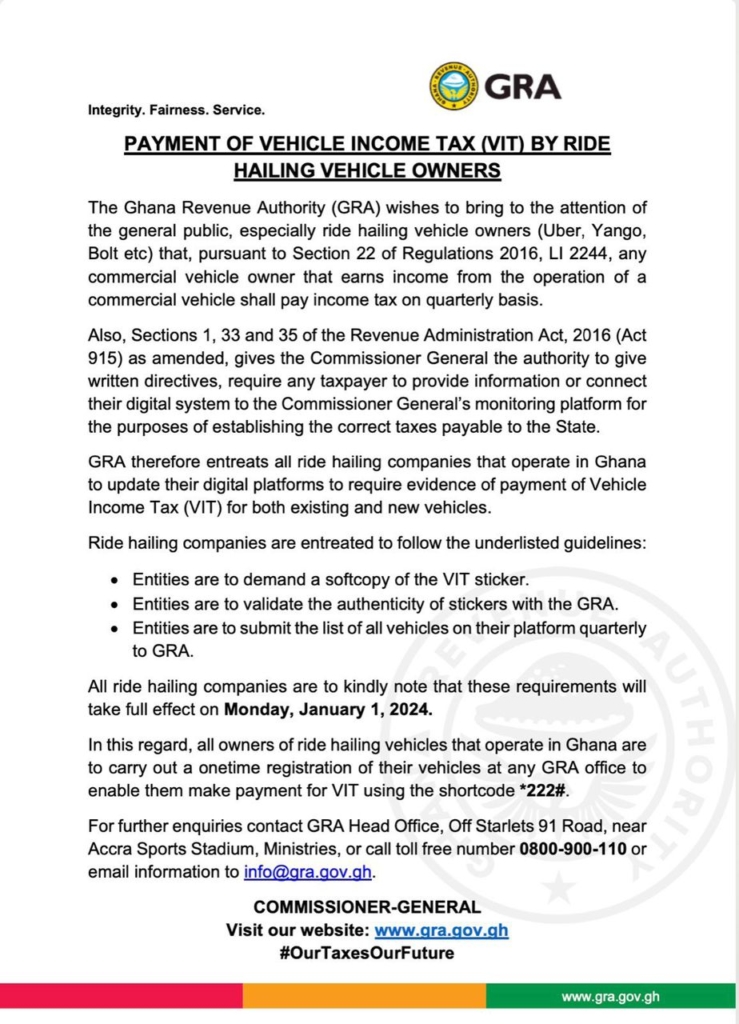

Starting January 1, ride-hailing vehicle owners liable for Value Income Tax

The Ghana Revenue Authority (GRA) notified ride-hailing vehicle owners about implementing Value Income Tax (VIT) from January 1, 2024.

According to Section 22 of Regulations 2016, LI 2244, commercial vehicle owners earning income must pay quarterly income tax. Ride-hailing companies like Uber, Yango, and Bolt in Ghana were urged to update digital systems to accommodate new tax rules.

Compliance guidelines include obtaining a digital VIT sticker, verifying it with the GRA, and submitting quarterly vehicle lists. Enforcement of these rules starts on January 1, 2024, as emphasized by the GRA.