The Minority in Parliament has accused the government of attempting to provide an extensive tax waiver of 7 billion Ghana Cedis to their associates within the trade industry.

This revelation has surfaced amid an existing request for a 5 billion Ghana Cedis tax waiver, currently under consideration by the Finance Committee, purportedly presented as incentive packages for the One District One Factory (1D1F) policy.

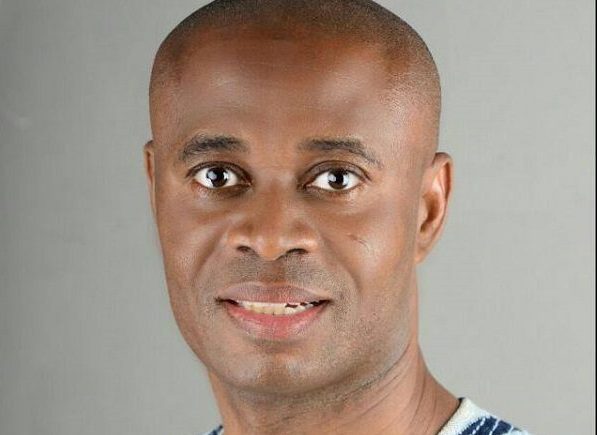

In a press conference held in Accra on Wednesday, Yussif Sulemana, the Ranking Member on the Trade and Industry Committee, cautioned that the Opposition would vehemently oppose any efforts to impose additional burdensome taxes on the citizens if the government does not abandon these questionable tax waivers.

“The 2024 budget alone is imposing taxes to the tune of GHS11 billion. The unfortunate thing is that while we are taxing the poor Ghanaians to raise this revenue, we are also at the same time granting tax waivers to friends and family members. For instance, we have about GHS5.5 billion tax exemptions waiting at the finance committee.”

“We have also been reliably informed, and we are speaking because we have seen documents that suggest that they’re bringing another GHS7 billion tax waiver request to parliament. Now, if you put the two together, we are talking about GHS12.5 billion tax exemptions.” Sulemana explained.

“Here you are wanting to grant GHS12.5 billion to your friends and family members in the name of tax exemptions under 1D1F. At the same time, you are imposing taxes to the tune of GHS11 billion. Can you juxtapose the two.”

“We think that it doesn’t make sense to us, and so we are saying that the tax bill that they are going to introduce in this particular budget will face some stiff opposition. We will not sit down and allow them to impose taxes on our people,” he stated.