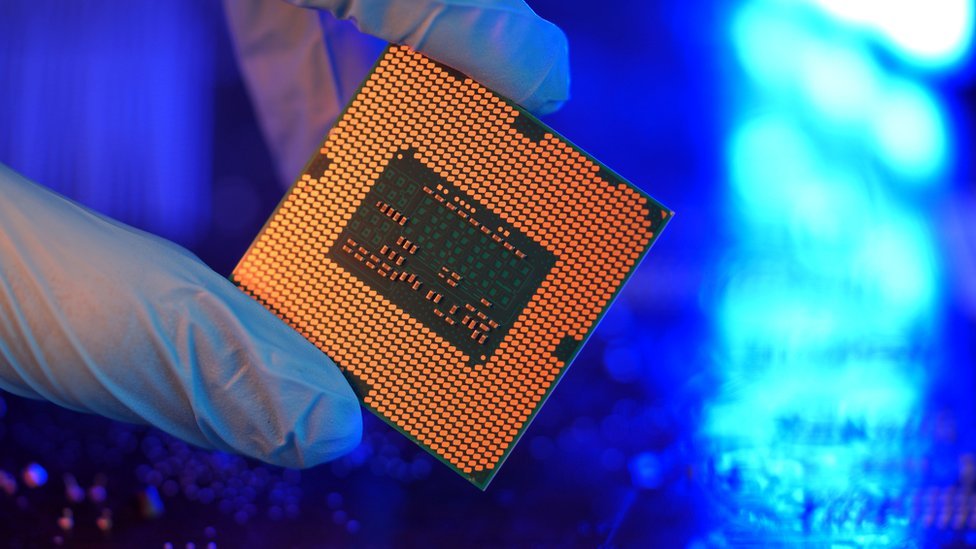

British microchip giant Arm files to sell shares in the US

Arm, a major British microchip designing company, has announced that it has filed the necessary paperwork to sell its shares in the US.

The Cambridge-based company, which designs chips from smartphones to game consoles, plans to go public on the Nasdaq in New York in September.

Arm withheld information about the number of shares being offered for sale or their price, but it is possible that this initial public offering (IPO) will be the largest since late 2021.

The company decided against listing shares in London in March, dealing a blow to the UK.

Arm declared on Monday that a registration statement for a potential IPO had been filed publicly. It stated that both the number of shares to be offered and their price range had not yet been decided.

However, the company is reportedly seeking a valuation of between $60 billion (£47 billion) to $70 billion.

In a deal worth £23.4bn, Japanese conglomerate Softbank acquired Arm in 2016. It was listed for 18 years in both London and New York prior to the takeover.

Technology giants Apple and Samsung, as well as manufacturers like the Taiwan Semiconductor Manufacturing Company, use its chip design guidelines and technologies to create their own chips.

A company becomes a public company when it is listed on a stock exchange, making it available to investors for the purchase and sale of shares of its stock on designated exchanges.

According to previous reports, the company hoped to raise between $8 billion and $10 billion through the listing on the Nasdaq platform, which is heavily weighted toward technology. Other major technology companies including Google, Apple and Facebook trade on the Nasdaq.

Source-BBC