Banks May Feel The Brunt Of Domestic Debt Exchange Program – Experts Predict

Dr. Richmond Atuahene, a Banking Consultant says the banking sector is bound to face dire liquidity challenges in the coming years due to the Domestic Debt Exchange Program by the government.

According to him responsible institutions must be analytical with their thinking and back it with data and science to mitigate the situation. He implored on them to do research on the impact of government’s Domestic Debt Exchange Program (DDEP) on the financial sector.

” Because you have done your work very well you present to the Minister. You tell him, minister from our perspective this is going to happen to us, and we don’t think it’s right. But everybody seems narratively. We must be very analytical, and data and science must come. So if you change the structure of the existing bond and you spread it for 15 years and you draw the coupon rates, it’s going to hit the bank very well,”

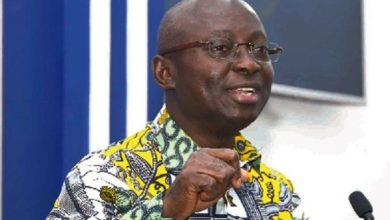

For his part, the President of the Ghana National Chamber of Commerce and Industries, Clement Osei Amoako says a behavioral change must be adopted towards government policies.

He called for a redefinition of the mode of operations, owning the economy, and chart economic reform policies for government, and added that government structure and governance would be looked at.